Slower Inflation and Strong Economic Growth: How the Federal Reserve’s Decision-Making Process is Being Affected

The Federal Reserve has been able to remain patient in its decision-making process due to the strong economic growth experienced in the US during the first quarter of 2024. Impressive…

A Taste of Carbondale: SIU Carbondale and Chamber of Commerce Partner to Host Unique Event for New and Returning Students

Southern Illinois University Carbondale is partnering with the Carbondale Chamber of Commerce to host a special event during Saluki Startup, an annual festival for new and returning students held in…

Shocking: Two Malaysian Navy Helicopters Collide in Rehearsal, Killing 10 Crew Members

On April 23, 2024 at 09:30 local time in Lumut, Malaysia, a tragic accident occurred when two Malaysian Navy helicopters collided mid-air during a rehearsal for a military parade. The…

Arglass and Zippe Join Forces for a More Efficient and Sustainable Glass Production in Valdosta, USA

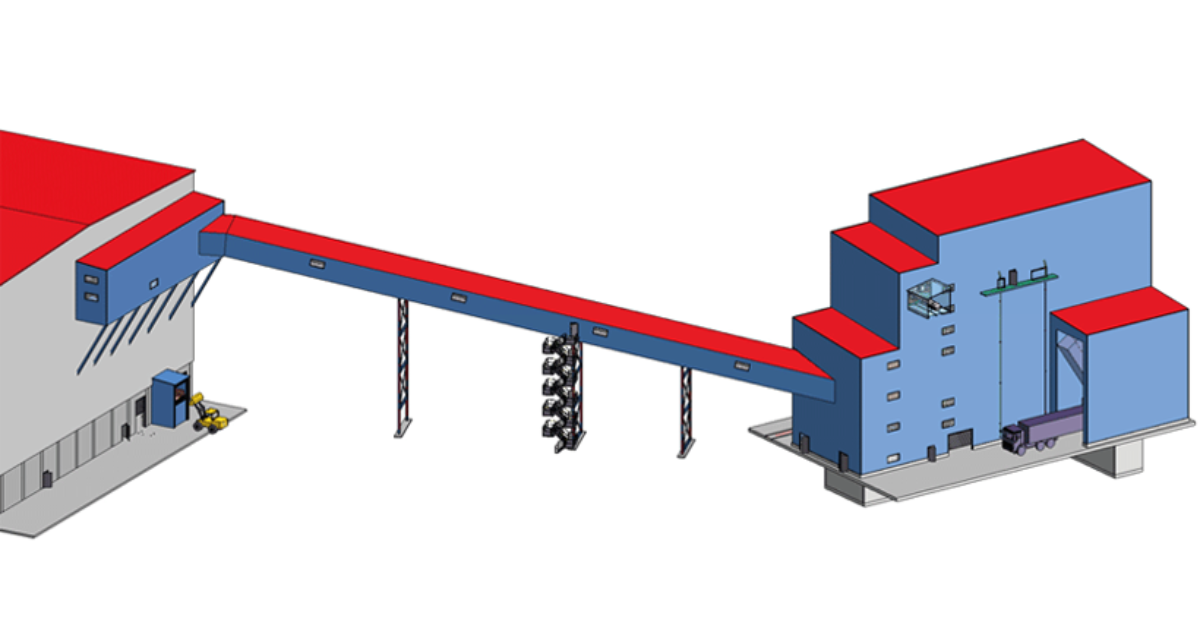

Arglass and Zippe are joining forces to construct a second Arglass plant in Valdosta, USA. The project is set to be completed in December 2024 and will be commissioned in…

JD Sports Looks to Expand in the US with Acquisition of Hibbett Inc Amid Tough Competition in Global Sportswear Market

JD Sports Fashion, a UK-based sportswear retailer, has proposed to buy US athletic fashion retailer Hibbett Inc for around $1.08 billion. The move is strategic as JD Sports aims to…

Spacecraft Spitzer’s Autonomous Safety Systems Updated for Unprecedented Orbit Challenges

As Spitzer’s orbit progresses beyond its current phase, it presents new challenges for the spacecraft. The distance between the two planets is increasing due to the slower pace of Spitzer’s…

RiverStone Health and Gainan’s Heights Flowers Partner to Offer Free Soil Lead Testing in Yellowstone County

As a journalist, I have rewritten the given article in a unique way. In Yellowstone County, despite the presence of lead in all parts of the environment, including air, water,…

Economic Prosperity and Political Concerns: The Impact of EU Enlargement on Central and Eastern Europe

Central and Eastern Europe has experienced remarkable economic growth since joining the European Union, with countries such as Poland, Hungary, Slovakia, Slovenia and Czech Republic accounting for 8.7% of EU…

Jerry Seinfeld on the State of the Movie Industry: A Chat with GK

In an interview with GK, Jerry Seinfeld recently shared his insights on the current state of the movie business. According to the comedian, there is a sense of confusion among…

Israeli Army Intelligence Chief Resigns After Hamas Attack: A Precedent Set for Accountability in National Security Matters?

In the aftermath of the events of October 7, Israeli army intelligence chief Aharon Haliva announced his resignation. He took responsibility for the attacks carried out by Hamas, which resulted…