Economy Minister Habeck Visits Ukraine and Moldova to Show Support for Freedom and Strengthen Ties

German Economy Minister Robert Habeck arrived in Kiev on Thursday morning, stating that his visit is aimed at showing support for Ukraine in its fight for freedom. He emphasized that…

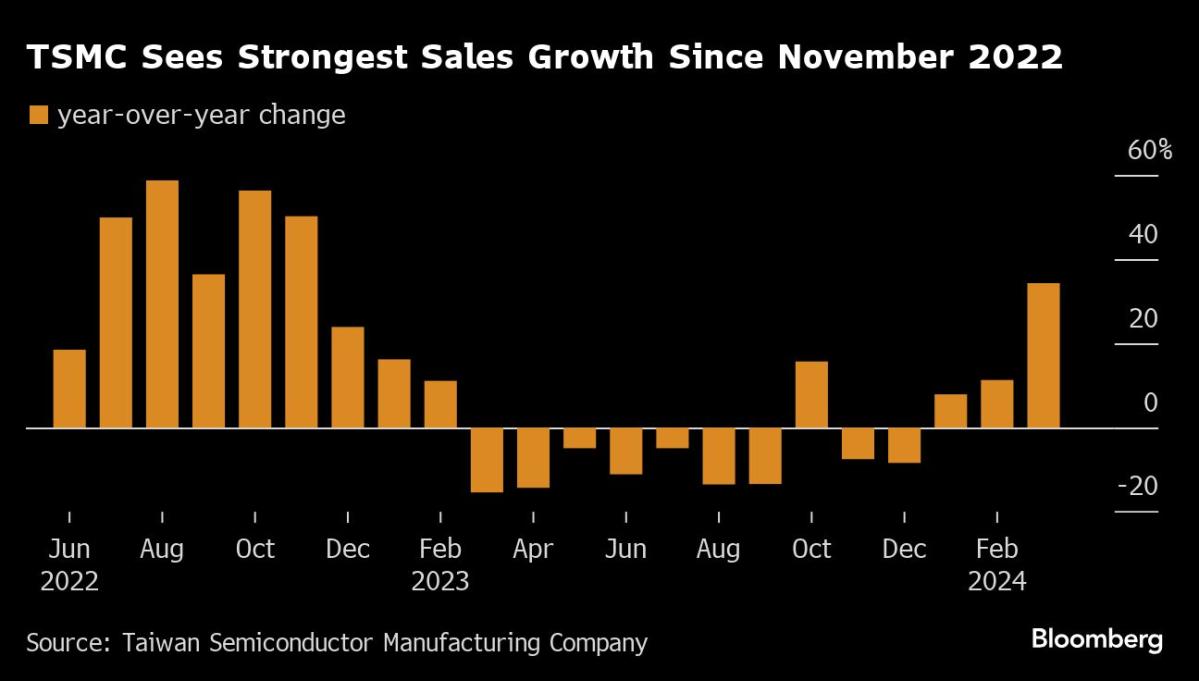

TSMC Capitalizes on AI Trend: Expects Revenue Growth of Up to 30% in Q2 Amidst Global Economic Instability

Taiwan Semiconductor Manufacturing Co. (TSMC) expects to see revenue growth of up to 30% in the current quarter, driven by a surge in demand for artificial intelligence (AI) technology. The…

Iranian President Warns Zionist Regime: Encroachment on Our Territory Will Be Met with Strong Opposition from Armed Forces

Iranian President Ebrahim Raisi issued a warning to the Zionist administration during the Army Day parade in Tehran, Iran. He emphasized that any encroachment on their territory would be met…

Unraveling the Past: A High-Quality Reference Genome of Arabica Coffee Reveals its Ancestry and Evolution

In Madrid, a team of scientists have sequenced the highest quality reference genome of Arabica coffee, the most popular variety of coffee. This genome has revealed secrets about its lineage,…

Ravens RB JK Dobbins Returns to the Gridiron with Chargers after Four Seasons on Injured Reserve

The Los Angeles Chargers have signed running back JK Dobbins to a one-year contract, LAA Sports confirmed. This move comes after Dobbins spent four seasons with the Baltimore Ravens and…

Exploring the Red Planet: A Virtual Tour of Curiosity’s Landing Site on Mars

The Curiosity rover, which is currently exploring the Gale Crater on Mars, is equipped with advanced technology to analyze rock, soil and air samples. This car-sized rover uses a 7-foot-long…

Expanding Medicaid crucial to addressing mental health crisis in Kansas, says Governor Kelly during Prairie View tour

In her tour of Prairie View, Inc. in Newton, Governor Laura Kelly emphasized the importance of expanding Medicaid to improve access to comprehensive mental health treatment for Kansans. She urged…

Protecting Intellectual Property: The Importance of Copyright and Associated Press Permission

This document is protected by copyright and may not be reproduced without permission from the Arkansas Democrat-Gazette, Inc. Additionally, any content from Associated Press (AP) must not be published, broadcasted,…

How Amazon Dominated E-Commerce During the Pandemic and Its Future Growth Potential Amid Competition

During the pandemic, online shopping has seen a significant increase, and the latest data reveals that Amazon Prime had 180 million members in March. This represents 75% of all US…

Colonel Marino Lugo’s Death Sheds Light on Venezuela’s Ongoing Corruption Scandal

Colonel Marino Lugo, a person of interest in the corruption scandal involving Venezuela’s state oil company PDVSA, was found dead in his cell. The authorities suspect that he may have…