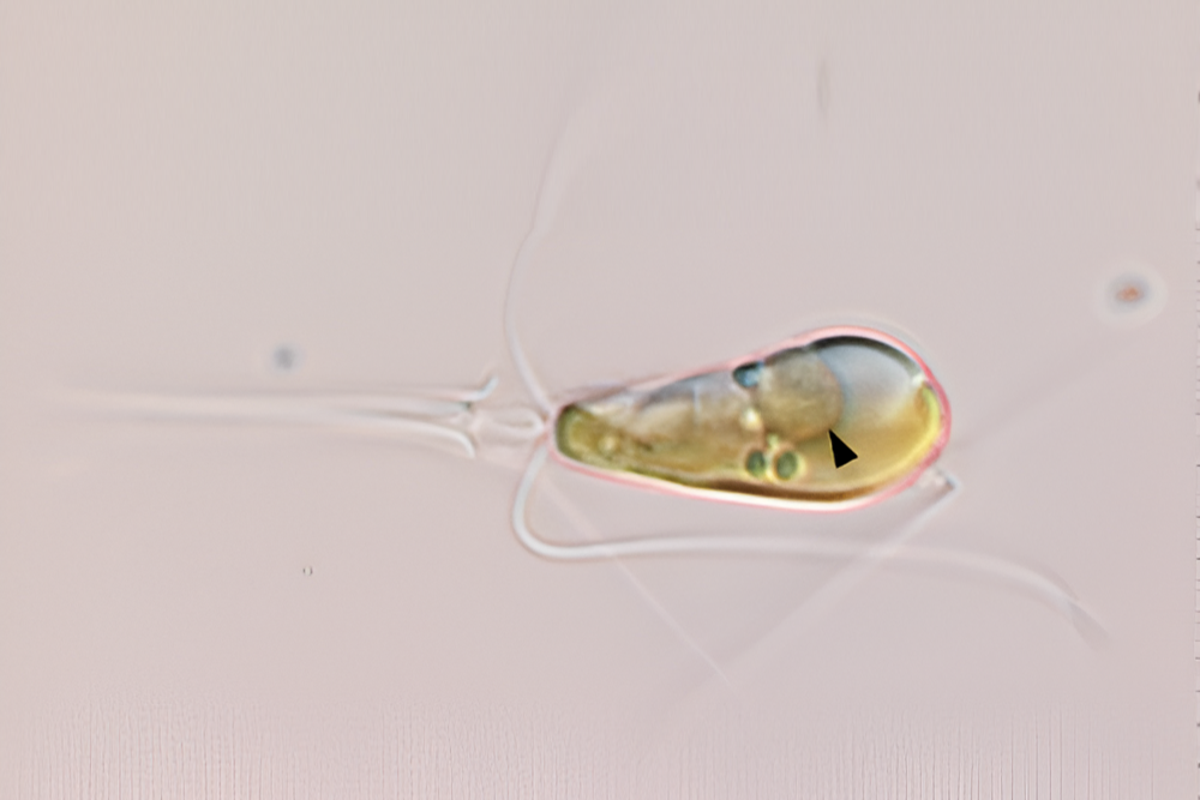

A Revolutionary Discovery: The Unique Symbiosis of Algae and Bacteria Leads to the Emergence of Mitochondria and Plants

Discover the incredible evolutionary event of primary endosymbiosis where two life forms have merged into one organism. This rare occurrence has only happened twice in Earth’s history, resulting in the…

Jessica Culver’s Journey: Grosvenor Teacher Fellowship Takes Her to Alaska’s Wilderness

Jessica Culver, a PhD student in the Adult and Lifelong Learning Program in the Faculty of Education and Health Professions, has been chosen to take part in the Grosvenor Teacher…

Preparing for the Future: Navigating Technological Advancements, Energy Transitions and Population Changes in Texas’ Job Market

The Lone Star State is currently experiencing steady growth, with over 15 million employed Texans. However, the future of work in Texas remains uncertain as technological advancements and climate change…

Transforming Homes on a Budget: FunCicled’s Kitchen Makeover Solutions

FunCicled is a local family business that started as a flipping company in Winnantskill in 2021. They have since expanded their services to include kitchen cabinet painting and interior design.…

Savoring the Sweetness: The World’s Largest Fish Festival in Paris, Tennessee

The 71st annual World’s Largest Fish in Henry County, Tennessee returned to Paris on April 20th, with the opening of the Fish Tent on April 24th. This event is a…

Align Technology Exceeds Expectations with Strong Financial Results, Key Metrics Indicate Continued Success

Align Technology ( ALGN ) has reported strong financial results for the quarter ended March 2024, with revenue of $997.43 million, up 5.8% compared to the same period last year.…

Record-Breaking Sports Travel Spending in 2023: The State of the Industry and Its Impact on Various Sectors

In 2023, the sports travel sector is expected to experience a total direct spending of $52.2 billion, with Americans taking a record 204.9 million trips related to sporting events. The…

Discovering the Nanoworld: Delta College’s Eyes of Science exhibit Brings Microscopy to Life

Delta College’s Eyes of Science exhibit provided insight into the world of electron microscopy during a recent free open house. Jose Jimenez, instructor of the program, explained that they use…

Rome Health Tackles Growing Demand for Care with $45.7 Million Expansion Project

Rome Health is currently working on a $45.7 million project to improve health services in the Mohawk Valley. The aim of this project is to meet the growing demand for…

Navigating Financial Challenges: VSF Bicycle Technologies GmbH’s Journey towards Recovery

In recent years, VSF Bicycle Technologi GmbH has been struggling financially due to a sharp decline in market volume at the end of 2023. The company, founded in 2020 and…