Major Insulin Manufacturers, Pharmacy Benefit Managers Involved in Deceptive Pricing Scheme: Lawsuit Alleges Unethical Tactics for Maximizing Profits at Patients’ Expense

A recent lawsuit filed in the U.S. District Court for the District of Connecticut accuses major insulin manufacturers and pharmacy benefit managers of engaging in a deceptive pricing scheme. The…

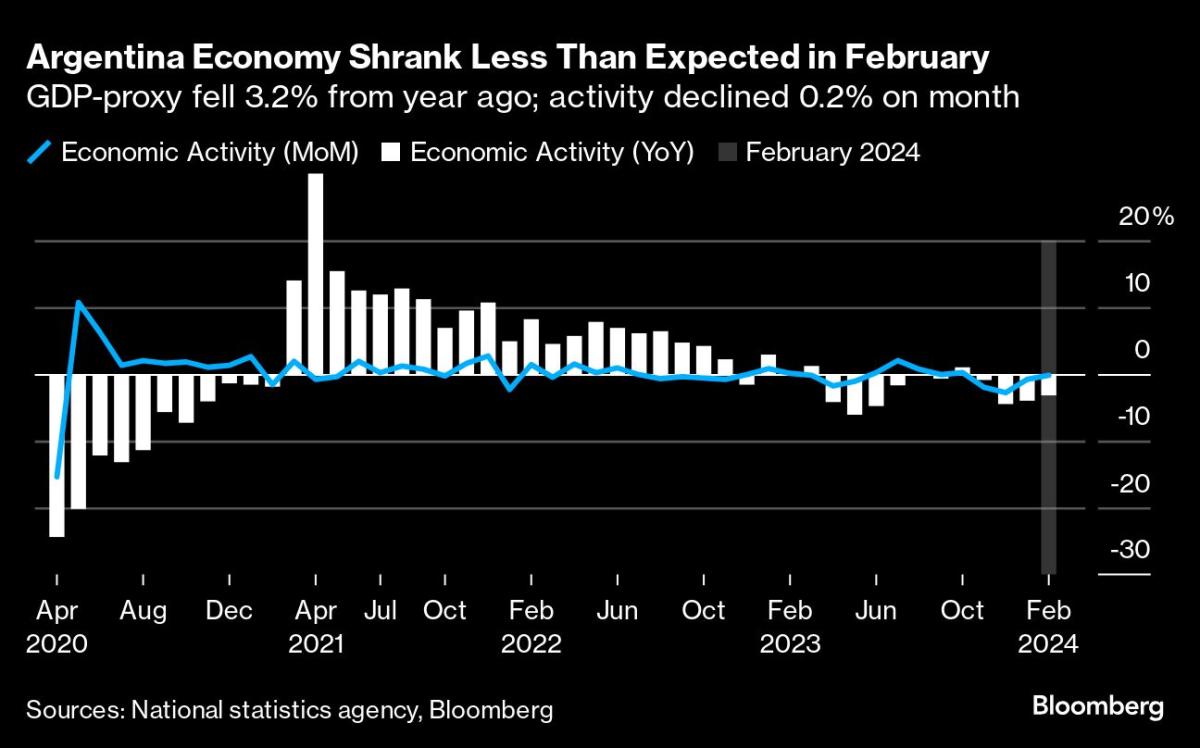

Against the Odds: How Argentina’s Fiscal Surplus Helped Stabilize its Economy in the Face of Inflation and Recession

In February, Argentina’s economy continued to contract for a fourth month in a row as President Javier Millei’s economic shock therapy plan began to take effect. Despite the ongoing recession,…

Excellence in Multimedia and Sales: VKU Student Publications Acknowledges Top Performers

During an awards ceremony held on April 19, three student leaders in VKU Student Publications were recognized by the college’s business and advertising managers. Emma Bayens, a senior photojournalism major…

Beijing’s Intelligence Operations in Western Countries: The Case of Maximilian Krach’s Aide and the Ethics of Ghostwriting in Academia

The recent arrest of an aide to German MEP Maximilian Krach, who is the main candidate of the far-right AFD party in the upcoming parliamentary elections in Strasbourg, has brought…

Woven City: The Futuristic Eco-Friendly Community Revolutionizing Urban Living

Woven City, a futuristic city located at the foot of Mount Fuji in Japan, is set to revolutionize urban living with its eco-friendly and technologically advanced design. The city, designed…

Max Scherzer to Make Triple-A Rehab Start in First Game Action Since Surgery

In his first game action since undergoing back surgery during the offseason, three-time Cy Young Award winner Max Scherzer is set to make a minor league rehab start Wednesday night.…

New Trier Science Olympiad Takes Home First Place at Illinois State Championships and Prepares for National Title

At the Illinois State Tournament, the New Trier Science Olympiad team demonstrated their impressive science skills by winning first place. The varsity team finished with 84 points, just two points…

Revolutionizing Access to Information: Understanding the Power of Navigation Results and Templates Cache

The Navigation results provide valuable information about the content being accessed, including its metadata and details such as the publication date, title, practice areas, channel sections, and reference link. Additionally,…

The Fight for Palestine: Protests and Controversy at Elite US Universities

Protests by pro-Palestinian students and activists at elite US universities are intensifying. At Columbia University in New York, Shay Davidai, a professor of business, was barred from entering the university…

USDA Lifts Employment Restrictions for McAllen Produce Company Settling PACA Restitution Order

Recently, the US Department of Agriculture (USDA) announced that Prometo Produce Corp., a McAllen, Texas-based company, had settled a $15,400 restitution order issued under the Perishable Agricultural Products Act (PACA)…