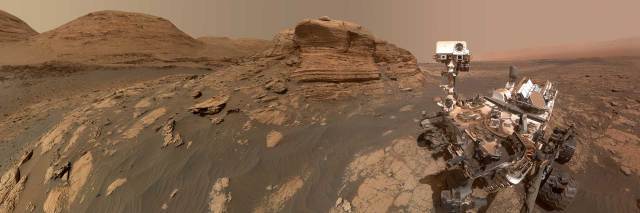

Exploring the Red Planet: A Virtual Tour of Curiosity’s Landing Site on Mars

The Curiosity rover, which is currently exploring the Gale Crater on Mars, is equipped with advanced technology to analyze rock, soil and air samples. This car-sized rover uses a 7-foot-long…

Expanding Medicaid crucial to addressing mental health crisis in Kansas, says Governor Kelly during Prairie View tour

In her tour of Prairie View, Inc. in Newton, Governor Laura Kelly emphasized the importance of expanding Medicaid to improve access to comprehensive mental health treatment for Kansans. She urged…

Protecting Intellectual Property: The Importance of Copyright and Associated Press Permission

This document is protected by copyright and may not be reproduced without permission from the Arkansas Democrat-Gazette, Inc. Additionally, any content from Associated Press (AP) must not be published, broadcasted,…

How Amazon Dominated E-Commerce During the Pandemic and Its Future Growth Potential Amid Competition

During the pandemic, online shopping has seen a significant increase, and the latest data reveals that Amazon Prime had 180 million members in March. This represents 75% of all US…

Colonel Marino Lugo’s Death Sheds Light on Venezuela’s Ongoing Corruption Scandal

Colonel Marino Lugo, a person of interest in the corruption scandal involving Venezuela’s state oil company PDVSA, was found dead in his cell. The authorities suspect that he may have…

The Dangers of Ballistic Missiles: How Interceptors Keep Us Safe and Protecting Our Navigation Systems

Ballistic missiles are a significant threat to many countries, and interceptors are essential in preventing them from causing harm. These rockets follow an arcing path above the atmosphere back to…

Unwavering Optimism and Determination: Luton Town’s Crucial Matches Ahead

As the season reaches its final stretch, Luton Town fans are eagerly anticipating their team’s upcoming matches against Brentford, Wolves, Everton, West Ham and Fulham. The team is determined to…

Freshman Wins Multiple Awards at Regional Science Fair for Independent Project on Cancer Prediction

Yusuf Ai, a freshman at Fayetteville-Manlius High School, recently received multiple awards at the regional science fair for his independent project titled “Cancer Prediction Through Modeling: Understanding Environmental and Hereditary…

Williamson Health Ranked Among America’s Top Hospitals for Women’s Services and More

Williamson Health has recently been recognized as one of America’s top hospitals, receiving numerous awards in various categories from the Women’s Choice Awards. The hospital has excelled in women’s services,…

Russia’s Economy Thrives Despite Sanctions and Conflict: Insights from the International Monetary Fund

The Russian economy is expected to grow by 3.2% in 2024, outpacing growth rates predicted for major advanced economies like the US. Despite the ongoing conflict in Ukraine, high levels…